The deepening financial risk of water scarcity

Axios’ Bryan Walsh reports: Roughly 60% of real estate investment trust (REIT) properties are projected to experience high water-stress by 2030 — more than double the number today, according to a report that Axios had early access to from BlackRock.

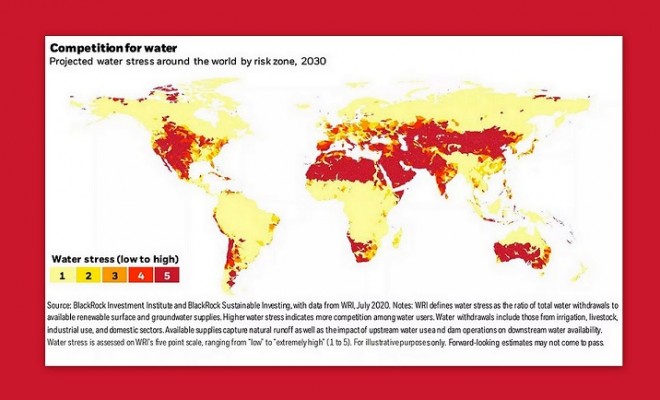

Why it matters: Climate change is set to exacerbate water scarcity in much of the world. Investors who fail to price in the cost of adapting to water stress risk being left high and dry.

Details: Water stress occurs when the need for water exceeds supply due to a combination of population growth and urbanization — which increases demand — and the effects of climate change, which can alter supply distribution.

- BlackRock used the distribution of REITs to identify where investors will feel the pain of water stress.

By the numbers: Almost all REIT properties in Malaysia, Japan, and Australia, among other countries, will likely be in what are classified as high-risk water zones within 10 years, according to the report.

- Roughly two-thirds of U.S. REIT properties are projected to be in high-risk water zones, double the proportion today. This includes most of the country west of the Mississippi.

- According to World Bank estimates, global water infrastructure costs are expected to rise fourfold by 2030, to $150 billion a year.

Yes, but: Water scarcity doesn’t automatically mean financial catastrophe — all of high-income Singapore, for example, is within a high-risk water zone today.

- But managing scarce water supplies in the future will both good governance and forward-thinking investment to get the most out of what’s left.

- Water use is also a good proxy for stewardship at both the national and corporate level, says Brian Deese, BlackRock’s global head of sustainable investing.

- “If you’re using water well, you’re usually doing other things efficiently, too.”

Of note: While the BlackRock report focuses on the risk to REIT properties, Deese says virtually all industries will be affected by the growing competition for water.

• BlackRock warns of risk from water scarcity

Roughly 60% of real estate investment trust (REIT) properties are projected to experience high water stress by 2030 — more than double the number today, per new analysis from asset management giant BlackRock that Axios’ Bryan Walsh obtained ahead of wide release.

Why it matters: Climate change is set to exacerbate water scarcity in much of the world. Investors who fail to price in the cost of adapting to water stress risk being left high and dry.

Details: Water stress occurs when need for water exceeds supply, due to a combination of population growth and urbanization — which increases demand — and the effects of climate change, which can alter the distribution of water supplies.

- BlackRock used the distribution of REITs to identify where investors will feel the pain of water stress.

By the numbers: Almost all REIT properties in Malaysia, Japan, and Australia, among other countries, will likely be in what are classified as high-risk water zones within 10 years, according to the report.

- Roughly two-thirds of U.S. REIT properties are projected to be in high-risk water zones, double the proportion today. This includes most of the country west of the Mississippi.

The big picture: The report comes as BlackRock is increasingly urging fossil fuel companies to get more aggressive on climate, part of a wider sustainability strategy unveiled this year.

Πηγή: axios.com