European banks could continue to disappoint investors

In contrast to the blowout returns of their U.S. counterparts last year, European banks delivered uninspired returns to investors.

What happened: U.S. banks like Citigroup and JPMorgan drove a 32% return for the S&P financial sector, slightly edging the S&P 500’s 31% rise.

- Europe’s bank stocks index ended 2019 up 8%, but trailed the broader European Stoxx 600, which rose 23%.

- Investors had lofty expectations to begin the year, WSJ notes, as the European Central Bank was expected to raise interest rates. But those quickly fizzled, and the ECB not only cut interest rates but restarted its TLTRO and quantitative easing stimulus programs.

- Some lenders have started charging to hold big cash deposits to reduce the sting of negative interest rates.

Why it happened: The ECB’s shift didn’t help, but banks’ troubles weren’t all a result of monetary policy, experts say.

- “It’s also lack luster prospects for economic growth,” Tom Essaye, president of Sevens Report Research, tells Axios. “The EU economy isn’t doing as well as the U.S. economy and as such, loan growth potential isn’t as good.”

- “In general loan demand is weak in Europe as are the economies in general,” Joseph Trevisani, senior analyst at FXStreet, adds in an email. “Cheap funds are not enough if no one wants the money.”

By the numbers: The eurozone grew at 0.2% in both the second and third quarters of 2019, and EU policymakers expect the bloc grew by just over 1% last year.

The bottom line: “Europe’s banks worked through the dreariness of 2019, in some cases admirably,” WSJ’s Rochelle Toplensky writes. “That is about the best investors can hope for in 2020 as well.”

• Eurozone producer prices sink again

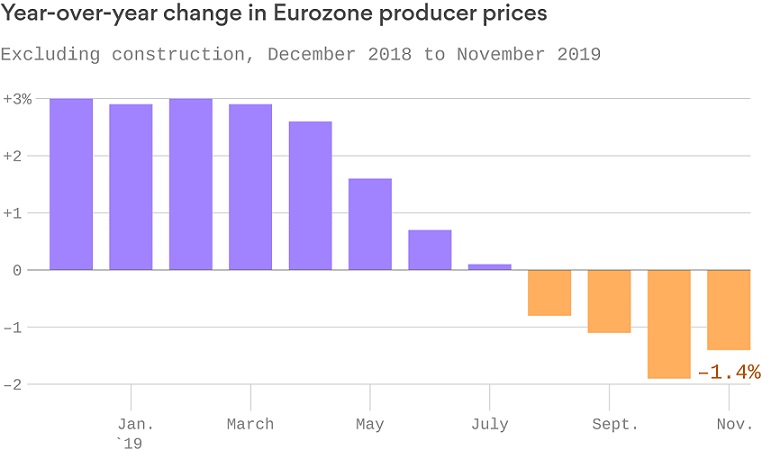

The continued decline in prices paid by manufacturers could be a major impediment to European policymakers’ desire for higher inflation in the eurozone, and data released Monday shows things are not improving.

What happened: The producer price index for the eurozone fell for the fourth straight month in November.

- The decline was less than economists expected, but still showed a more than 1% drop after a nearly 2% fall in October.

Why it matters: The ECB has cited lagging inflation as a major risk to growth and stability in the region and inflation’s inability to rise to the central bank’s 2% target as a reason for increasing its bond-buying program and cutting interest rates late last year.

- Headline inflation moderately improved to 1% in November and economists expect it rose further to 1.3% in December, but the consistent drag from producer prices may inhibit that.

What’s next: Eurostat will release its preliminary PPI estimate for December today.

Πηγή: axios.com