The eurozone economy is getting worse

ECB president Mario Draghi and a spate of data releases from IHS Markit on Monday painted an incredibly somber picture of the economic situation in the eurozone.

What they’re saying: “Recent data and forward-looking indicators — such as new export orders in manufacturing — do not show convincing signs of a rebound in growth in the near future,” Draghi told the European Parliament’s Committee on Economic and Monetary Affairs.

- It was a far cry from “Whatever it takes,” the 3-word mantra that Draghi is best known for saying in the midst of Europe’s 2012 downturn.

What they’re (really) saying: Phil Smith, an economist at IHS Markit, which compiles the reports on manufacturing and service sector activity, was far less kind.

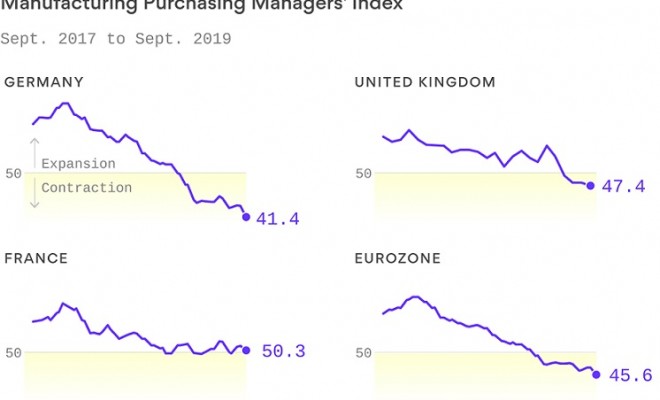

- “The manufacturing numbers are simply awful,”he said in a statement accompanying the release.

Why it matters: The eurozone looks like it’s headed for recession, if it isn’t in one right now. And, as Draghi pointed out, there’s little on the horizon that gives much hope for the future.

- “The longer the weakness in manufacturing persists, the greater the risks that other sectors of the economy will be affected by the slowdown.”

The big picture: The ECB has cut interest rates to -0.5% and will begin pumping around $22 billion a month into the economy through its bond buying program, but its president has used his last 2 public appearances to warn that it’s not enough.

- “We need a coherent economic strategy in the euro area that complements and enhances the effectiveness of monetary policy,” Draghi said.

Between the lines: The data back up his point. The eurozone as a whole had its worst reading on manufacturing in 7 years in September while Germany’s manufacturing sector showed its worst reading in a decade. The services sector is also starting to slip.

- “All the uncertainty around trade wars, the outlook for the car industry and Brexit are paralyzing order books, with September seeing the worst performance from the sector since the depths of the financial crisis in 2009,” Smith added.

- “With job creation across Germany stalling, the domestic-oriented service sector has lost one of its main pillars of growth. A first fall in services new business for over four-and-a-half years provides evidence that demand across Germany is already starting to deteriorate.”

• Money managers fear recession is coming, but still like stocks

More than half of money managers think a global economic downturn is likely next year, a survey of 200 institutions that oversee $4.1 trillion in assets found.

- It was the first time the survey conducted by Absolute Strategy Research has shown a recession likelihood greater than 50% since the survey began in 2014.

Why it matters: “People have definitely bought into the bearish macro view,” said ASR’s head of research David Bowers, according to the Financial Times. “When you look at the pattern over the past four or five years, it is definitely quite an important inflection point.”

- However, the survey also suggests investors are betting that monetary policy will help calm the waters and have continued to buy risky assets like stocks.

- “They haven’t gone maximum defensive,” Bowers said. “People are thinking the cavalry is going to come quickly to create stimulus to provide that turnaround.”

Πηγή: axios.